So, what exactly does Workforce Perks do?

Workforce Perks provides a service to employers to take their existing ‘match’ budget and allow employees to direct a % to their 401K and a % to pay-down their student loan.

For example, let’s say you match contributions up to 4% with immediate vesting… dollar for dollar up to 3% and 1/2% for each whole percent to the full 4% (9% total).

Jim makes $60,000 base per year. He elects to max out his match and allocates 5% of his salary ($3,000) to his 401k. Your company matches Jim’s contribution at 4% ($2,400).

Without Workforce Perks...

Jim’s annual contribution to his 401k plan is $5,400 ($450 per month). Bravo Jim! 👏

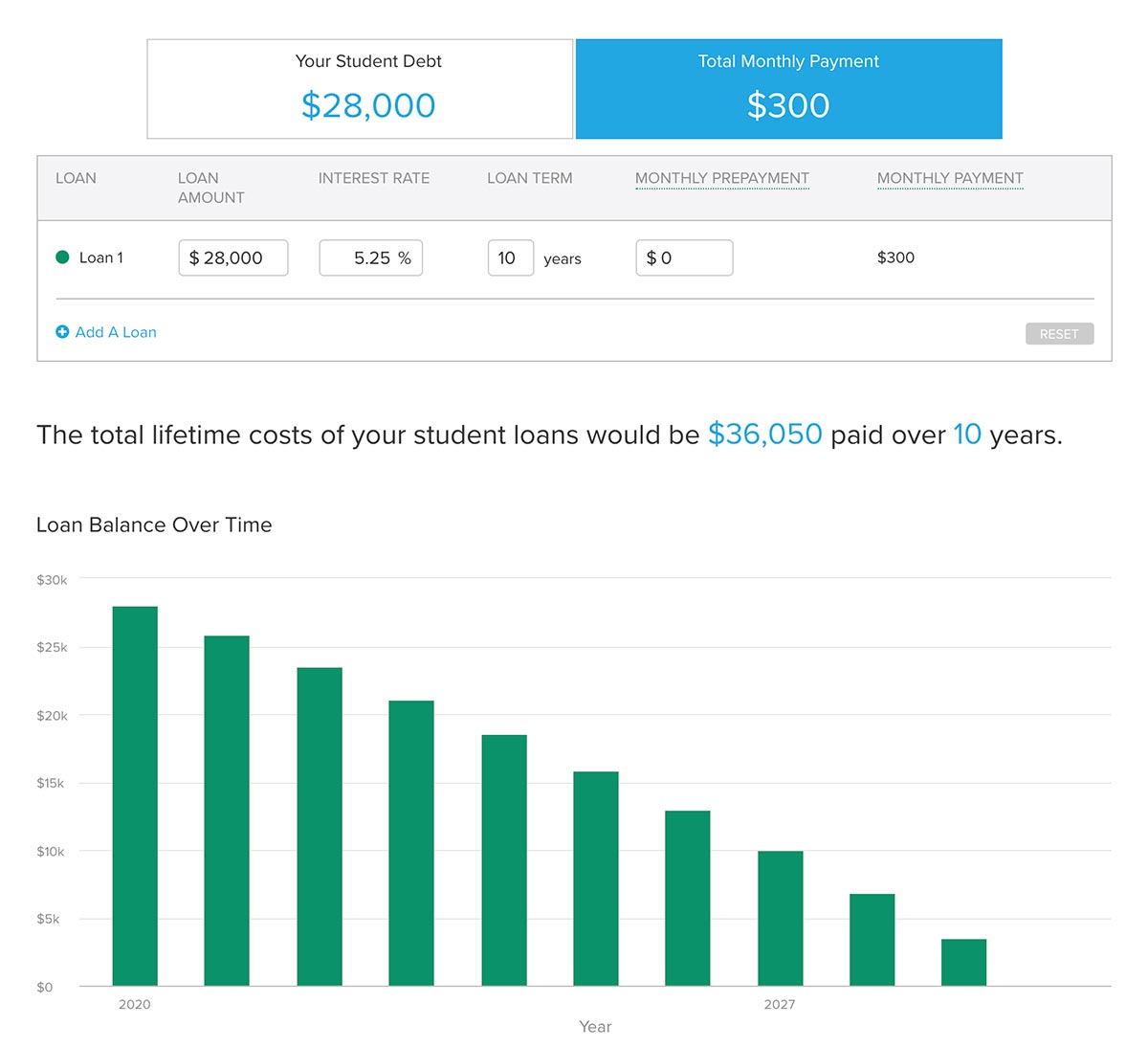

But Jim has $28,000 in student loan debt which he pays $3,600 annually ($300 per month).

30 years from now, Jim may dig his decision but he’ll be dealing with student loan payments for at least the next 10 years.

With Workforce Perks...

You give Jim an option that he’s never had before. A choice in his financial future that could help him save 30% over the lifetime of his student loan. This option doesn’t cost more than 2 cups of coffee per month. Jim’s worth at least that much, right?

Jim considers his options and decides that he wants to focus more of the generous employer match towards his short term liabilities. Rather than investing $5,400 per year in a 401k, Jim wants to get out of debt a little bit quicker.

Jim elects to shift his investment supported by your generous matching dollars. It looks like this…

$250 - Student loan paydown

$200 - 401k contribution

If Jim continues to make his normal out of pocket monthly student loan payment of $300 + diverting the match, he’s on pace to pay off his loan in 5 years.

You just saved Jim $4,000 in principal + interest and cut his payback period by 5 years!

Who gets the hand clap now!?! Bravo you HR genius… Bravo 👏

Frequently Asked Questions

1.) What if my company already has a 401-k administrator and broker?

Nice work! You’re already doing a lot of the right things to help recruit and retain key employees by offering a 401k plan.

You are NOT required to change your current 401k plan, administrator or broker. Think about Workforce Perks like an à la carte or add-on to what you’re already offering.

2.) I already offer a Student Loan Payment benefit. How is this different?

It’s probably not using your existing match budget though, right?

If you don’t have a flexible matched student loan benefit platform, like what Workforce Perks provides, your employee is putting even more strain on their financial situation than necessary.

They are trying to max out your match and putting money to work in their 401k even though the more pressing financial concern is paying off their loan.

Give them a choice. Give them flexibility.

Let each team member decide how to direct their match dollars whether its reducing short student loan debt or investing in their retirement which may be 30 years away.

3.) Do I need to change my current 401(k) administrator and broker?

No, you do NOT need to change your current retirement plans to enable Workforce Perks. Our platform is a simple add-on to your existing benefit plans.

4.) What about tax contributions?

Currently, a Participant will pay ordinary income tax on both the Employee contributions and the Employer contributions.

The tax landscape is changing as of April 1, 2020 with new regulations introduced through the CARES Act. Employers may be able to add contributions and record them on payroll as pre-tax. More information on this benefit can be found here.

Contact our team to learn more about the tax advantages of a Student Loan Benefit contributions: [email protected]

5.) We have a vesting schedule for participation. How does Workforce Perks manage this?

All contributions will be transferred from the company to the Student Loan Repayment plan(s) on a monthly basis. Three options are available below:

- Allow anyone to participate regardless of vesting (most popular).

- Restrict participation only to those who satisfy the vesting cliff.

- Require participants to sign a Promissory note, similar to a Tuition Reimbursement program, whereby the unvested portion of payments are liable for repayment to employer if the employment ends early. This is the least popular election.

6.) Will Compliance Testing be impacted when I offer a Workforce Perks Student Loan Benefit?

Consider the impact to the Actual Deferral Percentage (ADP) Test which limits HCE’s to 2% more than the average of NHCE’s.

- Adding a Non-Qualified Deferred Compensation program would allow the HCE’s to defer a larger contribution than NHCE’s.

- Adding a mid-year test administered by the Recordkeeper for the Retirement Savings Plan would allow the employer enough time to adjust HCE contributions.

7.) How much does this cost?

There is a one-time implementation fee and an average monthly cost per participant of $4.50

8) Is Workforce Perks a Bank or Loan Provider?

No. Unlike our competitors, we will not offer loans or refinancing of loans to your employees.

We do offer a free consulting service for employees that you can offer in your benefits package too.

9) What if I don't employ a lot of people who have student loans?

Oh yeah!?! How about asking your team and looking at real data. And don’t just focus on the millennials. How many of your employees have kids who are college age? Over 20% of student loans are carried by the student’s parents.